Tax accountants use their knowledge of tax laws and regulations to ensure that their clients comply with the law and minimize their tax liability. Tax accountants may also be involved in tax planning and advising clients on how to structure their affairs. Financial accounting focuses on the financial statements prepared for external users, such as shareholders and creditors. The goal is to provide accurate and timely information that will help these individuals make informed decisions about the company. As an accountant, you can specialize in different areas of accounting, each with its unique accounting is a prepaid expense recorded initially as an expense career path, certification requirements, and average salary. If you enjoy working with numbers, you might find that one of the accounting fields below is right for you.

- This type of accounting career path can be challenging and interesting, which can provide you with a great deal of intellectual stimulation.

- Whether you use accounting software, outsource your books to a virtual accountant or employ an entire team of in-house CPAs, bookkeeping and accounting are essential components of your day-to-day business operations.

- For example, accounting firms could offer online appointment booking and/or easy-to-use software for gathering client information.

- As the accounting field continues to evolve, new types of accounting are likely to emerge to meet the ever-changing business and organization’s needs.

- Accounting is a growing industry in the US, having generated over $141 billion in 2022, according to Statista’s research 1.

- Accountants help businesses maintain accurate and timely records of their finances.

Harnessing AI and automation: How to elevate your tech stack

Accounting history dates back to ancient civilizations in Mesopotamia, Egypt, and Babylon. how to correctly calculate report and reverse accruals For example, during the Roman Empire, the government had detailed records of its finances. However, modern accounting as a profession has only been around since the early 19th century.

Yet, the events between then and now, including the Covid-19 pandemic, have instead shown that accountants, like other professionals, need to worry much more about adaptation than replacement. As far back as 2015, industry leaders were sounding the death knell for accountants, convinced emerging technologies — particularly automation — would end in death by digital for accountancy as we know it. Adolfo Marquez from MBS Accountancy has rounded up 15 of the best no-code tools to help you boost your accounting firm’s efficiency. By getting ahead of trends, and focusing on the right skills, firms can use the changing accounting environment to perfect their craft and find (and retain) clients.

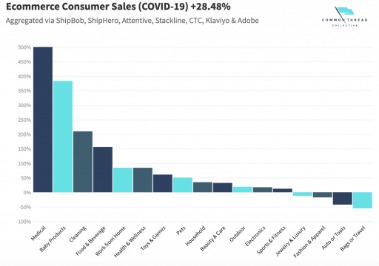

As a management accountant, you may also choose to open your own accounting practice or become a consultant. Regulatory changes and clients demand were primary drivers of the shift, of course, but the overall understanding was that these accounting industry trends and efficiencies could help firms increase their revenue. By the start of 2020, most tax, accounting, and audit firms were migrating to technologies — such as cloud platforms and robotic process automation — that automated much of their arduous manual work.

COMPANY

For example, public companies are required by law to use Generally Accepted Accounting Principles (GAAP), while private companies may use any accounting method that suits their needs. Accounting is a back-office function where employees may not directly interface with customers, product developers, or manufacturing. However, accounting plays a key role in the strategic planning, growth, and compliance requirements of a company. The Securities and Exchange Commission has an entire financial reporting manual outlining the reporting requirements of public companies. Larger companies often have much more complex solutions to integrate with their specific reporting needs.

Types of Accounting: Careers, Degrees, and Salaries

Sure, AI, automation, and even technology that doesn’t exist yet will mean that you’ll no longer need to perform many of the tasks you used to. But the reality is that machines can’t build human relationships like humans can, and they can’t combine intuition with experience to deliver great client service. Looking into the distant future, it’s difficult to predict how far the digital transformation will go. Learn more about the critical importance of technology adoption, the benefits of an integrated tech stack, and the potential pitfalls of a “watch-and-wait” approach.

You must stay up-to-date on the latest changes to prepare your clients‘ taxes properly. Additionally, tax accountants must be able to navigate the complex web of tax laws to find the best way to minimize their clients‘ taxes and provide tax advice. Tomorrow’s accountants may play an advisory role, welcoming business intelligence and procurement professionals and working to chart a strategic sourcing plan. They could leverage data management tools, including augmented reality, to humanize and contextualize spend data for the C-suite to make better decisions based on long-term value rather than return on investment alone.

TechRepublic

While financial accountants often use one set of rules to report the financial position of a investment income taxes company, tax accountants often use a different set of rules. These rules are set at the federal, state, or local level based on what return is being filed. Accountants, for example, can put their uniquely human skills to work transforming the insights extracted from high-quality data into more effective financial planning and reporting. Similarly, automation reduces costs and improves efficiency by eliminating tedious and time-consuming manual labor (e.g., data entry, three-way-matching) and reduces human error.